In the intricate world of personal finance, understanding where your money goes is the bedrock of effective budgeting and financial stability. Without this fundamental comprehension, it’s like trying to navigate a dense fog – you might be moving, but you have no clear sense of direction or how far you’ve come. At the heart of this understanding lies the distinction between fixed expenses and variable expenses. These two categories define the nature of your spending, influencing everything from how much you can save to how easily you can adjust your budget in times of need.

For beginners in personal finance, this distinction might seem academic, but in practice, it’s a powerful tool. Grasping the characteristics of each type of expense allows you to build a more realistic budget, identify areas for cost-cutting, plan for unpredictable costs, and ultimately, gain greater control over your financial destiny. Let’s delve deep into what sets fixed and variable expenses apart, explore practical examples, and discuss how recognizing their differences empowers you to become a true master of your money.

The Unchanging Core: What Are Fixed Expenses?

Fixed expenses are the financial bedrock of your life. By definition, these are costs that remain relatively constant or the same each month, regardless of your activity level or usage. They are predictable, recurring, and often represent your essential commitments. Think of them as the anchors of your budget – they hold steady, providing a sense of stability but also a significant portion of your required monthly outlay.

The key characteristic of fixed expenses is their predictability. You know exactly how much you’ll owe and when it’s due. This consistency makes them easier to budget for, as you can allocate a precise amount of your income to cover them without much guesswork. However, while “fixed” implies they don’t change, it’s important to note that they might not stay exactly the same forever. For instance, your rent might increase when your lease renews, or your insurance premium could be adjusted annually. But within a typical monthly or even yearly budget cycle, their amount is generally stable.

Common Examples of Fixed Expenses:

- Rent or Mortgage Payments: This is typically the largest fixed expense for most households. It’s a non-negotiable cost for shelter.

- Loan Payments:

- Car Loan Payments: The amount you pay each month for your vehicle finance.

- Student Loan Payments: Fixed installments for educational debt.

- Personal Loan Payments: Regular payments on any personal loans you’ve taken out.

- Insurance Premiums:

- Health Insurance: Monthly payments for medical coverage.

- Auto Insurance: Regular premiums for vehicle coverage.

- Life Insurance: Fixed payments for life coverage.

- Renter’s/Homeowner’s Insurance: Premiums to protect your living space and belongings.

- Fixed Subscription Services:

- Streaming Services: Monthly fees for Netflix, Spotify, HBO Max, etc. (assuming they are fixed price plans).

- Gym Memberships: Regular monthly charges for fitness facilities.

- Software Subscriptions: Monthly or annual fees for productivity software, creative suites, etc.

- Fixed Utility Bills:

- Internet/Cable TV: Often a set monthly fee, although usage-based overages can sometimes occur.

- Fixed Phone Plans: Plans that offer unlimited calls/data for a set monthly price.

- Childcare Costs: If you pay a fixed monthly fee for daycare or a nanny.

The Role of Fixed Expenses in Budgeting:

Because fixed expenses are so predictable, they form the base layer of your budget. When you’re planning your finances, these are the first costs you account for after your income. They dictate the minimum amount of money you need to have coming in each month just to maintain your basic commitments. If your fixed expenses consume too large a percentage of your income (e.g., more than 50-60%), it leaves very little flexibility for variable expenses, savings, or unexpected costs, putting you at a higher risk of financial strain.

Advantages of Fixed Expenses:

- Predictability: Easy to budget for and plan around.

- Stability: Provides a clear picture of your baseline financial commitments.

- Foundation for Goals: Once covered, you know how much discretionary income you have for other goals.

Disadvantages of Fixed Expenses:

- Less Flexible for Cuts: Difficult to reduce quickly if you need to free up cash. You can’t simply stop paying your rent or car loan.

- Can Be a Burden: If too high relative to your income, they can severely limit financial freedom.

The Ever-Changing Flow: What Are Variable Expenses?

In contrast to their predictable counterparts, variable expenses are costs that fluctuate or change from month to month, depending on your consumption, activity level, or lifestyle choices. These expenses are less predictable, making them a bit more challenging to budget for, but also offering significantly more flexibility when you need to cut costs.

Variable expenses are directly tied to your habits and decisions. The more you use, consume, or participate in certain activities, the higher these expenses will be. This means you have more control over them, as you can consciously adjust your behavior to increase or decrease the amount you spend in these categories.

Common Examples of Variable Expenses:

- Groceries: While essential, the amount you spend can vary greatly based on meal planning, eating out habits, brand choices, and food waste.

- Dining Out/Takeaway: Directly dependent on how often you eat at restaurants or order food.

- Utilities (Fluctuating):

- Electricity: Varies significantly with usage (air conditioning, heating, lights).

- Water: Changes based on consumption.

- Gas: Can vary based on heating usage, especially in colder climates.

- Transportation (Usage-Based):

- Fuel (Gasoline/Diesel): Directly related to how much you drive.

- Public Transport Fares: Varies with how often you use buses, trains, etc.

- Ride-Sharing Services: Costs depend on frequency of use.

- Car Maintenance/Repairs: Unpredictable, though necessary over time.

- Personal Care: Haircuts, toiletries, cosmetics, spa treatments – depends on frequency and choice.

- Entertainment/Recreation: Movies, concerts, sports events, hobbies, leisure activities.

- Clothing/Shopping: Varies greatly based on needs and desires.

- Miscellaneous/Unplanned Expenses: Unexpected small costs, gifts, impulse buys.

- Household Supplies: Cleaning products, paper towels, etc.

- Pet Supplies/Care: Food, toys, vet visits (can have fixed parts, but often variable).

The Role of Variable Expenses in Budgeting:

Variable expenses are where most of your budgetary flexibility lies. If you find yourself overspending or needing to free up cash for savings or debt repayment, these are the categories you can most easily adjust. By making conscious choices (e.g., cooking at home more, reducing subscriptions, driving less), you can directly impact your monthly outflow.

Advantages of Variable Expenses:

- Flexibility: Easily adjustable to accommodate changes in income or financial goals.

- Control: Direct control over how much you spend in these areas based on your habits.

- Opportunity for Savings: Often the first place to look for quick cost reductions.

Disadvantages of Variable Expenses:

- Less Predictable: Can make precise budgeting more challenging without careful tracking.

- Requires Discipline: Prone to overspending if not monitored closely.

- Can Lead to Budget Busts: Uncontrolled variable spending is a common reason budgets fail.

Why Differentiating Matters: Implications for Your Financial Health

Understanding the difference between fixed and variable expenses is not just an academic exercise; it has profound practical implications for your financial planning and well-being.

- Budgeting Accuracy and Realism:

- By knowing your fixed costs, you establish your baseline financial commitment. This is the minimum income you need to cover your unchanging obligations.

- Variable expenses allow you to allocate the remaining portion of your income more flexibly. You can experiment with different spending levels in these categories to find what works without compromising your essential needs.

- A budget that accurately distinguishes between these two types of expenses is a realistic budget – one that you can actually stick to.

- Identifying Cost-Cutting Opportunities:

- When you need to save money quickly, your primary focus should be on variable expenses. It’s much easier to reduce dining out, buy generic groceries, or limit entertainment than it is to renegotiate your rent or car payment.

- While harder, you can sometimes reduce fixed expenses over the long term (e.g., refinancing a loan, moving to a cheaper apartment, canceling unused subscriptions, or negotiating insurance rates). This is a more strategic, less immediate approach.

- Building an Emergency Fund:

- Understanding your total fixed expenses is crucial for determining the size of your emergency fund (typically 3 to 6 months of essential expenses). This ensures you have enough to cover your non-negotiables if your income suddenly stops.

- Financial Flexibility and Adaptability:

- A high proportion of fixed expenses relative to your income means less financial flexibility. If your income drops, you have fewer levers to pull to adjust your spending.

- Conversely, a lower proportion of fixed expenses means you have more wiggle room with your variable spending, making your budget more adaptable to changes in circumstances.

- Achieving Financial Goals:

- Once your fixed expenses are covered and controlled, the amount you save and invest comes largely from managing your variable expenses wisely. Every dollar you save by making smart choices in variable categories is a dollar that can go towards debt repayment, investing, or specific savings goals (like a down payment or vacation).

- Mindful Spending:

- Tracking variable expenses forces you to be more mindful of your daily spending habits. Seeing how much you spend on coffee or impulse purchases can be a powerful motivator for change. It encourages you to think before you buy.

Putting It All Together: An Action Plan

- Track Your Spending Diligently: For at least one month (ideally two or three), meticulously record every single dollar you spend. Categorize each transaction. This is the only way to accurately identify what falls into “fixed” and “variable.”

- Identify Your Fixed Expenses: List all expenses that are largely the same each month. Sum them up. This gives you your financial baseline.

- Analyze Your Variable Expenses: Look at how much you spend in each variable category. Are there patterns? Are there areas where you consistently overspend compared to your intentions?

- Set Realistic Budget Limits:

- Allocate your fixed expenses first.

- Then, consciously decide how much you want to spend in each variable category. Be realistic – don’t cut so much that you feel deprived and give up.

- Ensure your total expenses (fixed + variable) are less than your income, leaving room for savings and debt repayment.

- Monitor and Adjust: A budget is not a one-time setup. Review it monthly. If you consistently overspend in a variable category, either adjust your budget for that category (if it’s a realistic need) or find ways to reduce spending in that area. If your fixed expenses are too high, explore long-term strategies to lower them (e.g., refinancing, moving).

Understanding the difference between fixed and variable expenses is more than just a financial concept; it’s a fundamental step towards financial empowerment. By knowing what you can control and what forms your essential core, you gain the clarity and flexibility needed to navigate your financial life with confidence, make informed decisions, and ultimately, achieve your most ambitious financial goals. It’s the first step from financial guesswork to genuine financial mastery.

Understanding the difference between fixed and variable expenses is a foundational skill in personal finance. If you want to take control of your budget and make smarter money decisions, you need to know what costs stay the same each month and which ones change. In this article, we’ll break down fixed vs. variable expenses in simple terms and explain how managing them properly can improve your financial health.

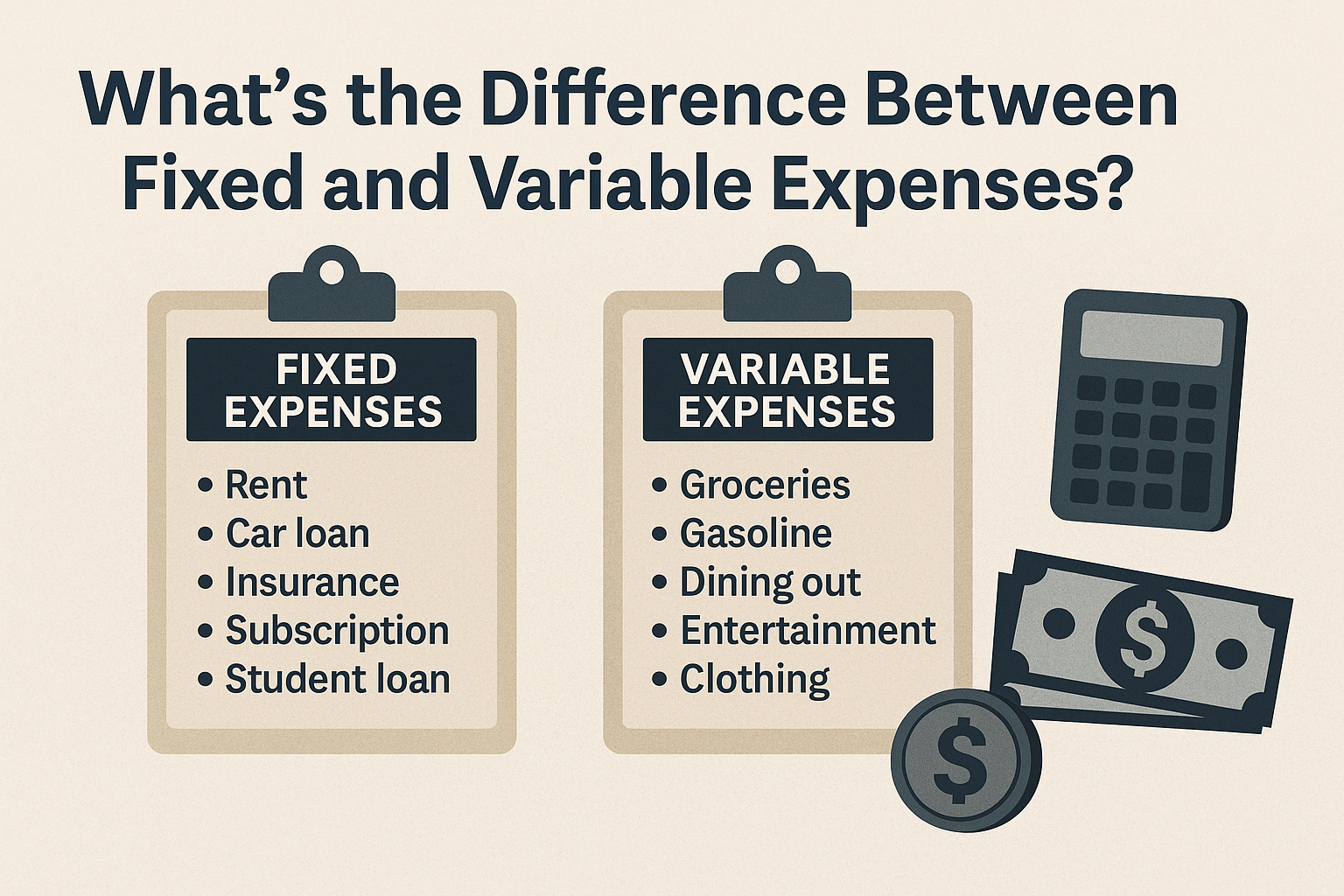

What Are Fixed Expenses?

Fixed expenses are costs that stay the same every month. They are predictable and recurring, making them easier to plan for in a budget.

Common Examples:

- Rent or mortgage payments

- Car payments

- Insurance premiums (health, auto, home)

- Subscription services (Netflix, Spotify)

- Student loan payments

These are the expenses that don’t fluctuate unless you make a change — like moving to a new apartment or renegotiating your insurance policy.

Why Fixed Expenses Matter:

- They form the backbone of your monthly budget.

- You can’t easily reduce them in the short term.

- Failing to pay them on time often results in serious consequences.

What Are Variable Expenses?

Variable expenses are costs that change from month to month depending on your usage, habits, and choices.

Common Examples:

- Groceries

- Gasoline or transportation costs

- Dining out

- Entertainment

- Clothing

- Electricity and water bills (can vary seasonally)

These costs are more flexible, and you have more control over how much you spend.

Why Variable Expenses Matter:

- They offer opportunities to cut back when money is tight.

- Overspending in this category is one of the main reasons budgets fail.

- With tracking and awareness, you can adjust your habits to save money.

Key Differences: Fixed vs. Variable Expenses

| Feature | Fixed Expenses | Variable Expenses |

|---|---|---|

| Amount | Stays the same monthly | Changes monthly |

| Predictability | High | Low to medium |

| Budget flexibility | Low | High |

| Examples | Rent, car loan, insurance | Groceries, gas, entertainment |

| Short-term adjustability | Difficult | Easy |

How to Balance Both in Your Budget

A healthy budget needs to account for both types of expenses. Here’s how:

1. Start with Fixed Expenses

These are non-negotiable. Add up your fixed costs to understand how much of your income is already committed.

2. Set Limits for Variable Expenses

Look at past spending and create a limit for each category. Use tracking apps or a spreadsheet.

3. Adjust as Needed

If your variable expenses push you over budget, you may need to make changes — like eating out less or canceling subscriptions to reduce fixed costs.

4. Build a Buffer

Set aside some money each month for unexpected fluctuations, especially in variable categories like utilities or fuel.

Tips to Manage Both Effectively

- Track every expense for at least one month to get a clear picture.

- Use the 50/30/20 Rule: Allocate 50% to needs (mostly fixed), 30% to wants (mostly variable), and 20% to savings and debt.

- Review your subscriptions annually — some fixed costs can be eliminated or reduced.

- Be flexible — your budget should reflect your real life, not a perfect plan.

Why This Matters for Financial Success

Understanding and managing your fixed and variable expenses is essential for:

- Avoiding debt

- Building savings

- Preparing for emergencies

- Reaching financial goals faster

When you master this distinction, budgeting becomes less stressful and more effective.

Final Thoughts: Know the Difference, Take Control

Fixed and variable expenses work together to shape your financial life. When you know the difference and budget accordingly, you gain more control over your money. You’ll be able to plan better, reduce stress, and make confident financial decisions.

Remember: it’s not about cutting every cost — it’s about knowing where your money goes and making it work for you.